Insurance Underwriting Made Seamless

Maximize revenue with our intelligent insurance underwriting software. Underwriting rules that automate quote creation, while closely managing risks and regulatory requirements.

WHY SEAMLESS’S UNDERWRITING SOFTWARE

Reduced cost

Automation helps avoid manual efforts and reduces them to the special cases that require human judgement. Insurers can significantly reduce the underwriting costs with straight-through processing.

Higher C-Sat

The fully automated insurance underwriting software reduces response time and allows insurance companies to react faster to applications. This improves the customer experience and customer satisfaction.

Faster time-to-market

Seamless’s insurance underwriting software enables subject matter experts to build underwriting logic easily and add new logic autonomously. The platform therefore, helps accelerate the time to market for changes and remain competitive.

BUSINESS VALUES THAT OUR CUSTOMERS ARE DRIVING THROUGH SEAMLESS UNDERWRITing

30% more policy underwritten through STP

80% less time spent on revising underwriting logics

40% more underwriting hours saved

FEATURES OF SEAMLESS underwriting

With Seamless’s underwriting software intelligently manage decisions, minimize underwriting risks and quickly convert prospects into customers.

Seamless’s underwriting module is built with automated data extraction feature, that pulls in information from images and pdf files. Empower your underwriters with pre-filled forms to conduct checks, calculations and assessments with 100% accuracy.

Seamless Underwriting makes it easy to define benefits and establish rules to ensure compliance and quote accuracy. In-built into the platform is a code-free, user-configurable rules engine to support unique permissions, workflows and authority levels.

Seamless Underwritng is part of a unified platform that has all the required information for underwriting stored in one place. Information is available and accessible in real time to make decisions and to enable straight-through processing from intake to enrollment.

INTEGRATIONS YOU CAN CHOOSE FROM

SEAMLESS CONNECT

Connect your business with better top-line growth and increased productivity with smart data-driven insurance risk scoring.

SEAMLESS ENGAGE

A self-serve customer engagement solution for Push Notifications, Email, SMS & In-App.

SEAMLESS FINANCE

A commission management software that centralizes commission tracking and enables detailed report and dashboard creation.

SEAMLESS FLOW

A multilevel drag and drop workflow design tool that simplifies insurance process automation. Achieve 90 percent reduction in process time from quote to customer.

SEAMLESS GROW

Unleash the power of automation to streamline insurance marketing and lead management.

SEAMLESS CLAIMS

With end-to-end digitalisation and straight through claims processing, automate the traditionally tedious claims review and approval process.

SEAMLESS PRICING

Be it usage-based insurance, simulation tools, rate testing, filing automation, or automated underwriting, with Seamless delivering the right pricing to customers.

SEAMLESS PRODUCTS

Create insurance products and test them seamlessly with our no-code, self-configurable software.

SEAMLESS UNDERWRITING

Create insurance products and test them seamlessly with our no-code, self-configurable software.

SEAMLESS GUARANTEE

Create insurance products and test them seamlessly with our no-code, self-configurable software.

DIVE DEEPER INTO SEAMLESS UNDERWRITE WITH OUR WHITEPAPERS AND BLOGS

Seamless.Insure strengthens its business activation team in the Nordics. Hires Carina Persson as Business Development Manager

26th August 2024 | Stockholm | Seamless.Insure is pleased to announce the appointment of Carina Persson as the new Business Development Manager for the Nordics region. With a strong background in driving business growth and forging strategic partnerships, Carina will...

Consumer Duty Regulations | Empowering Consumers | Seamless Insure

New Consumer Duty Regulations The Impact on the Insurance Industry, and the Tech Revolution In today's digital age, consumers wield unprecedented power and influence, often driving market changes through their choices and demands. Recognising this, governments and...

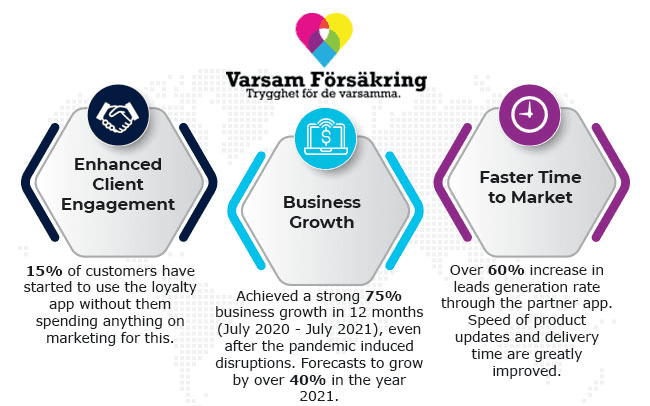

Swedish Insurance Distributor Varsamma Ab Achieves 75% Growth With Faster Speed To Market Using Contemi Solutions

“The Contemi systems, including the various customised features and functions, were developed as per our business strategies. We are satisfied that Contemi has managed to build the functions according to our high demands and expectations.” - Roger Holmgren, CEO,...